Cash App is the Fintech Disruption We Need

Well-established industries provide the infrastructure, consistency, and expertise to keep our economy chugging along; however, every so often it becomes necessary for these incumbents to be challenged. This necessity could arise from bloated operations, inappropriate social context, inconveniences built into the product, along with a range of other potential catalysts.

Fintech (short for “Financial Technology”) essentially describes any technology which facilitates financial services. While the word “technology” implies innovation, there are many facets of this industry which are fragmented and clinging to the past. Two of the main hurdles to innovation within fintech are regulation and rent-seeking behavior.

Financial services are highly regulated to help protect citizens from fraud (think Bernie Madoff), poor stewardship over resources (like the events that preceded the 2008 financial crisis), and to maintain the authority of both fiscal and monetary policy in relation to the management of the economy.

Rent-seeking behavior allows individuals and/or institutions to receive compensation that is disproportionate to the amount of value they actually provide. This is exemplified by under-performing co-workers or even previously disrupted business practices such as charging commissions to trade equities on behalf of investors.

So, what does Cash App have to do with any of this?

Cash App is creating a platform which is leveraging three principles of disruption: Defragmentation, Democratization, and Decentralization.

Defragmentation

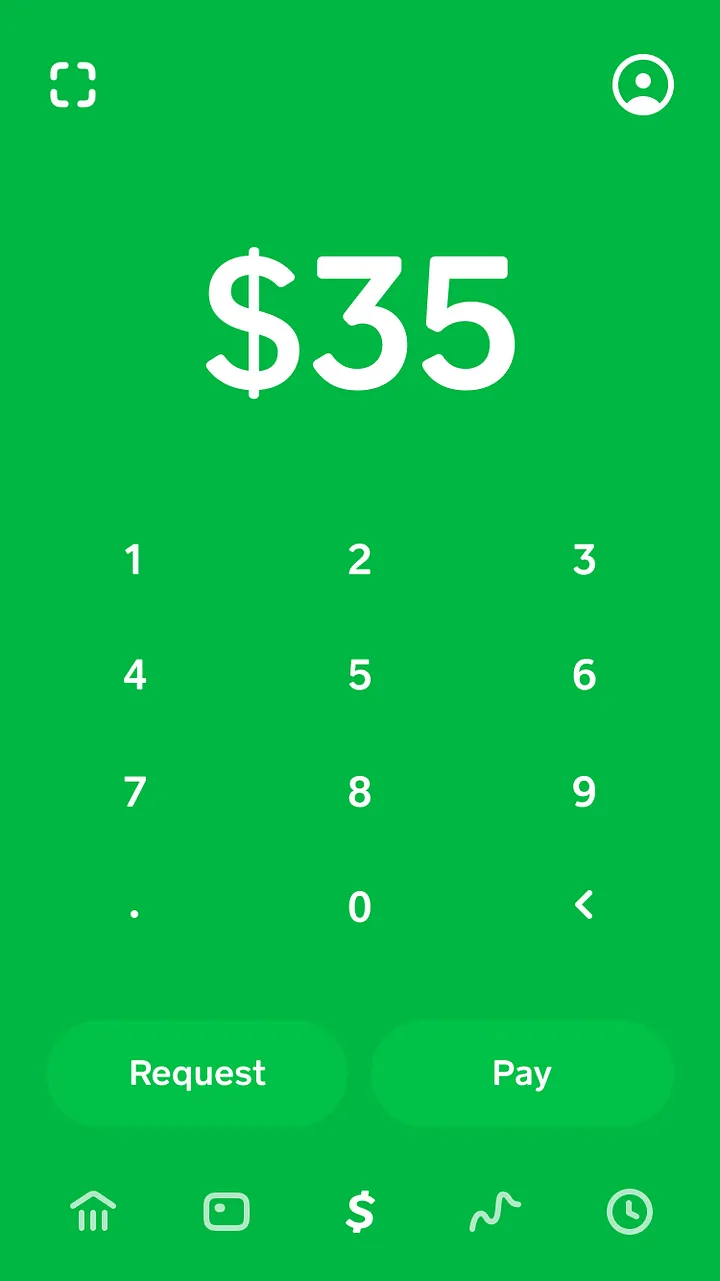

Cash App has consolidated multiple financial services into one “Super App”. Not only does this eliminate inconveniences for the consumer who can now have a home base of sorts to manage their finances, it also creates economies of scope. Economies of scope describe situations where a company can produce multiple products at a lower cost than multiple companies producing those same products.

Democratization

It’s a hard concept for many of us to comprehend, but there are still many people who don’t have access to banking, modern payment technologies, and even investment opportunities (less-so recently) for a variety of reasons. On top of that, there are even more people who don’t have enough knowledge of our financial system to effectively participate in it. Cash App provides a simple platform with almost no fees and very few barriers to opening an account.

Additionally, free peer-to-peer payments and fractional shares are inherently democratic services that the platform provides.

Decentralization

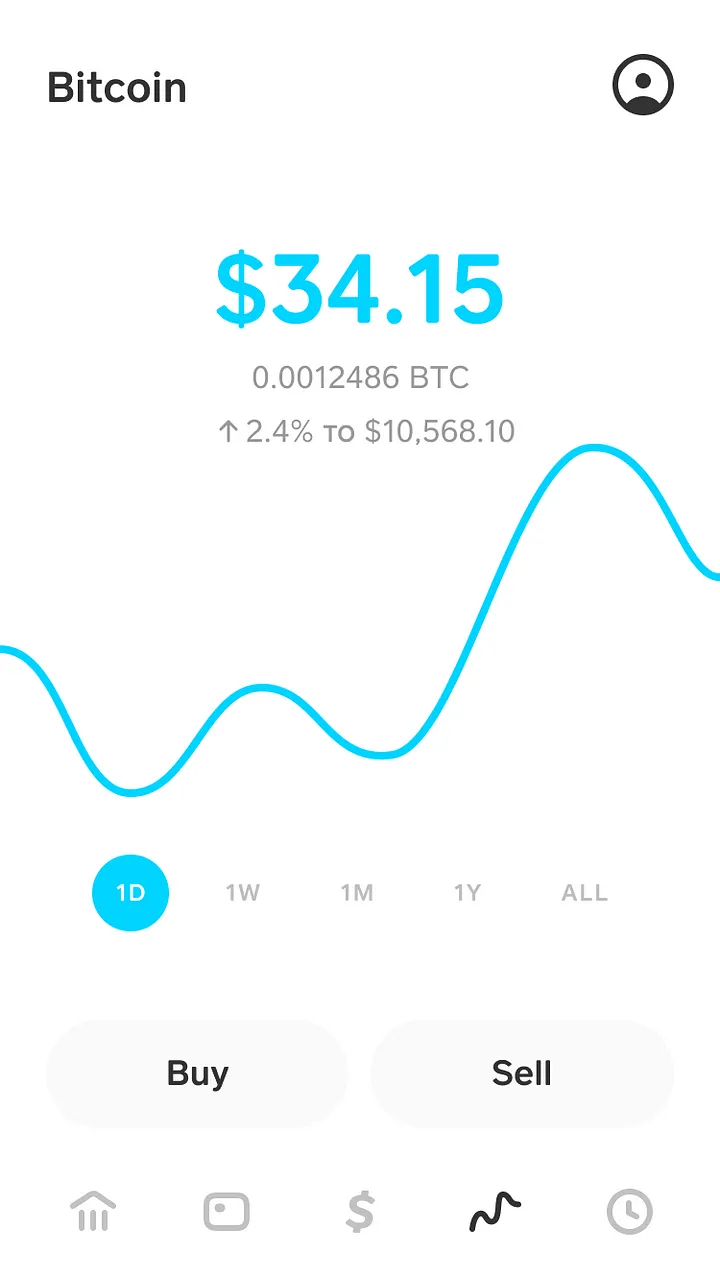

Skipping the clearing houses and major brokerages are just part of the decentralized service that Cash App provides. It also provides a more controversial service that supports Bitcoin. While Bitcoin (and cryptocurrency in general) has been the subject of manic speculation, there are fundamental use cases for it that shouldn’t be ignored.

If you’re not already using Cash App, you can sign up using the following link and we’ll both get $5:

© Trevor French.RSS